FILED IN: MARCH 2023 TRENDS IN EQUIPMENT FINANCE, EQUIPMENT LEASE FINANCE ASSOCIATION TRENDS, ASSET FINANCE, LTI TECHNOLOGY FINANCE, OMAHA, NE FINANCE

Digital Technology Trends in the Equipment Finance Industry for 2023 and beyond

The equipment finance industry has always been at the forefront of change in the finance world and is an essential part of the economy. One of the most significant digital technology trends in recent years is the increasing importance of digital platforms. These platforms are enabling businesses to connect easily with lenders and customers. This evolution of various digital technology trends, it is yet again, changing the face of how businesses in the equipment finance world do business into 2023 and beyond. Technology platforms are helping the equipment finance industry adapt to meet the changing needs of its customers and the increasing demands in this competitive market.

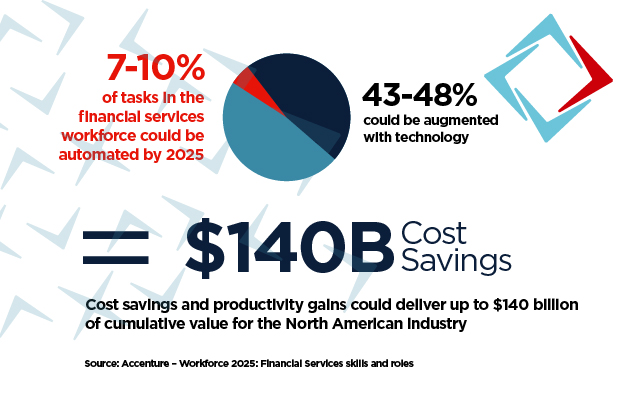

In another report by Accenture,

Looking to the future of the industry, today and beyond 2023, it’s clear that technology will continue to play a big role in shaping the industry. In this whitepaper, we will examine the trends that are driving digital technology trends for equipment finance companies and their customers, the challenges, as well as the opportunities that are ahead. Exploring the most prominent trends in 2023.

Several key trends that are driving these technology trends and transforming the equipment finance industry. These include:

1. Automation: it changing the equipment finance industry by streamlining processes and providing faster, more accurate decision-making.

2. Digital Platforms: are transforming how equipment finance companies interact with their customers. The technology ecosystem of these platforms enable customers to apply for financing, manage their account and access information and services online.

3. Internet of Things (IoT): is providing real time data on the performance and usage of financed equipment. The data can be used to improve maintenance schedules, predict equipment replacement timeframes, and identify opportunities for cost savings.

4. Block-chain tech: is providing greater transparency and security within equipment finance transactions. Enabling companies to create secure records of equipment ownership and transactions, reducing risk for fraud and errors.

Benefits of these trends for equipment finance companies and their customers.

The benefits of these trends for these companies and their customers are significant. They offer:

1. Increased Efficiency: digital platform technology ecosystems streamline processes, reducing time and effort to process applications, finalize approvals and manage the account.

2. Improved Decision-Making: companies can make more informed decisions, faster, reducing risk and improving profitability.

3. Enhanced Customer Experience (CX): digital platforms enable a more personalized and easy customer experience (CX). Customer can access information and services online and manage their accounts, which reduces in-person interactions.

Challenges and Opportunities

While new technology trends offer significant benefits, there are challenges and opportunities as well. These include:

1. Security: as equipment finance companies become more reliant on the technology platforms, security becomes an increasing concern. Businesses must ensure they have strong security measure in place.

2. People: working in technology requires a skilled team that has knowledge of the technology platforms managing the workflow. Companies will need to invest in training and development of their teams to ensure they have the talent required to succeed.

3. Underutilization: while the technology offers significant benefits for company and customer, often, their team members do not embrace and adopt the new technology. Companies must work to get the education and training for both their internal team as well as encouraging their customers to embrace the new technology platform.

Conclusion

In conclusion, digital technology trends are always reshaping the equipment finance industry by providing significant benefits for both equipment finance companies and their customers. Automation, digital platforms, IoT and block-chain tech are all key advantages that drive profitability. But there will be challenges ahead. Having a technology partner that is well versed in the benefits and potential challenges with years of experience is the key to successful digital transformation.

Sources

1 EQUIPMENT LEASING & FINANCE INDUSTRY HORIZON REPORT 2022

2 https://www.accenture.com/us-en/insights/financial-services/workforce-2025-skills-roles-future

3 https://www.elfaonline.org/knowledge-hub/sefa-survey-of-equipment-finance-activity